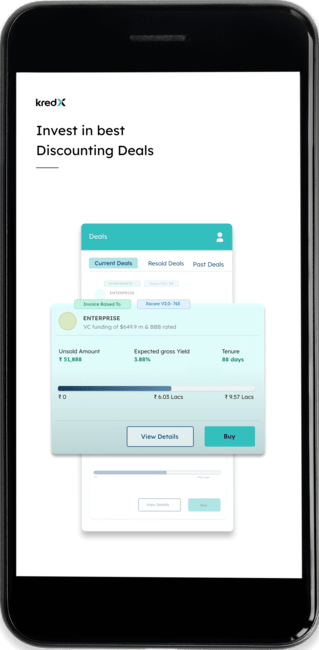

Any investment comes with its own associated risk. The risk could be total capital erosion. However, we have taken several steps to mitigate the risk – both strategically and operationally:

1. Comprehensive risk management framework – Detailed credit analysis of sellers and their financials at onboarding

2. Verification process - Invoices are verified physically. Moreover, invoices are restricted to only blue-chip companies.

3. Strong legal framework – All sellers are required to sign our legal agreements to ensure our investors are well protected.

4. If a blue-chip company does not pay the invoice money in the future – the small business is still liable to pay the money owed to the investor.

5. If the small business collapses, the blue-chip company would still pay the invoice money and this will be paid directly into the escrow account which will be transferred to the investor.

6. KredX is a tech platform and it does not assume any credit risk on behalf of the investors.