Alternative Investments – The Next Big Thing

Post the 2009 economic crisis, investors have been on the hunt for financial avenues with higher returns and lesser tenure. Enter Alternative Finance, the new-age sibling of traditional finance and banking. The alternative finance industry has seen a boom worldwide and India too is catching up on the trend.

In the past, our parents invested in traditional financial instruments like fixed deposits, real estate, gold, insurance policies and the like. Fast-forward to the present day. You have a great job, you earn well and you’re looking to invest some money. Sure, we all know about the conventional routes of investment. But what about alternative investments, the latest buzz word in the financial world? In a nutshell, alternative investments can be defined as any form of investment that falls outside of conventional banking and stock market investment. Here we introduce you to some of the popular forms of alternative investments.

Crowdfunding:

Multiple investors contributing funds online towards a project is called crowdfunding. The two forms of crowdfunding are investment-based crowdfunding as followed by businesses and donation-based crowdfunding as followed by NGO’s and Non-Profit Organisations generally.

Startups generally run equity-based crowdfunding campaigns on specific platforms to fund the execution of their ideas. This is a good form of investment as individuals who contribute towards the funds of a company become shareholders or own a part of the startup as a result.

Popular Indian crowdfunding platforms include Ketto, Wishberry, and Start51 among others.

Peer-to-Peer Lending:

Traditionally, small businesses would approach banks for loans to finance their expansion goals or for working capital. However, they were given loans at a much higher rate of interest because banks perceive lending to small businesses as extremely risky. To circumvent this problem, peer-to-peer business lending emerged as a form of funding.

Online P2P platforms have since gained popularity as they put the businesses and lenders in touch with one another. Small businesses and individuals can fund their needs without collaterals and at lower interest rates than what banks offer and in turn, investors earn attractive returns by investing cash that is lying idle.

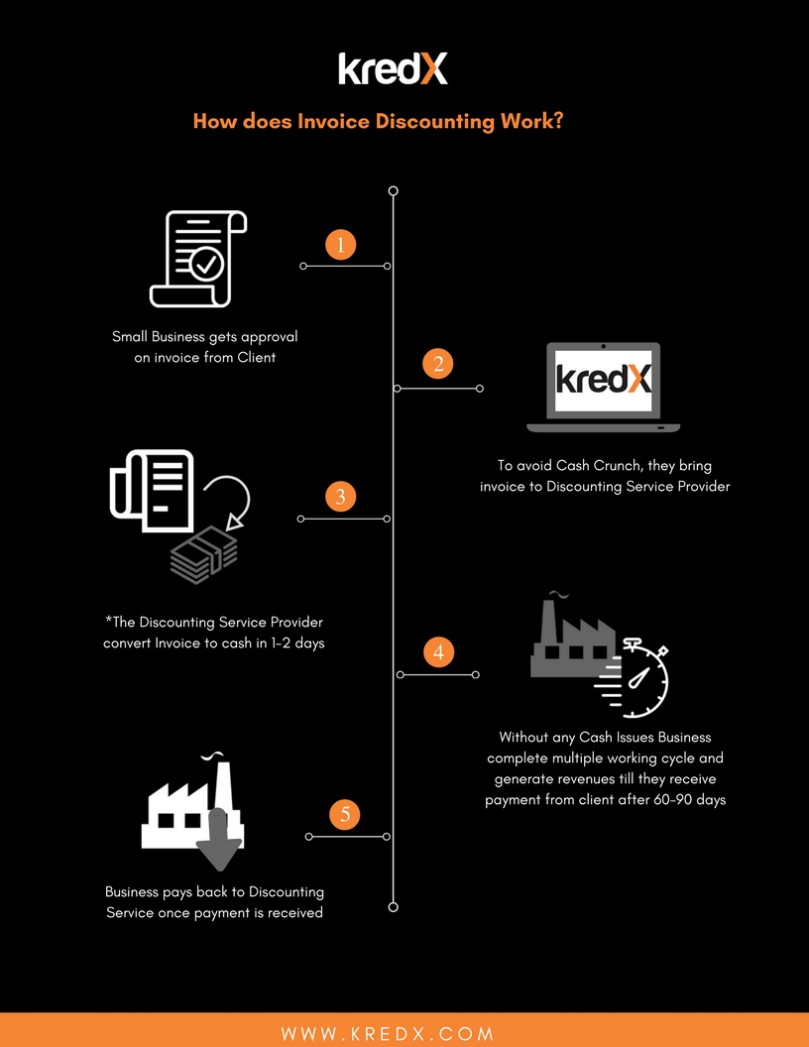

Invoice Discounting:

It is a form of investment where investors use their funds to pay a business’s invoice using the invoice as a pseudo collateral. KredX, India’s first invoice discounting marketplace, is an example of invoice discounting. Businesses receive an invoice for delivered goods or services from a bluechip company. The business then uploads the invoice on the KredX platform after discounting the total amount. Investors see the available invoices when they log in to the platform and select the ones that interest them and pay for them. The funds are then transferred to the business in 48-72 hours. In essentiality, the business foregoes a small amount of their profit for a quicker payment that otherwise takes 90 days on an average. This ensures their cash flow isn’t affected. In turn, the investors get lucrative returns on funds that were sitting idle in a short turnaround time at a much higher rate than what banks offer for traditional investments.

Investing in Hedge Funds:

A hedge fund is an alternative investment that use pooled funds to earn returns for their investors in the form of different strategies. Hedge funds not only protect the capital you invest, but also promise returns. Interestingly, hedge funds haven’t taken off very well in India as it is perceived as a risky investment option only meant for the rich. With the introduction of the Alternative Investment Funds (AIFs) by Securities and Exchange Board of India (SEBI) in 2012, hedge funds were open to domestic investors for the first time. Since 2012, hedge funds such as DSP BlackRock, Karvy Capital, Motilal Oswal, etc have slowly begun to gain popularity as viable investment options.

Collectibles:

Physical assets whose value appreciates with time such as coins, fine art, jewelry, art-work, stamps and so on, are called a collectible. This is often overlooked as a means of investment but this is a great tool for investment because the value of the asset increases with time irrespective of inflation. On the flip side, returns are not guaranteed and it takes very long for the value of the asset to appreciate considerably. If you have a family heirloom or a prized sports card you could make a lot of money selling it in auctions or antique houses years later; hold on to them!

According to a report from AlliedCrowds, India leads the list of developing countries with the most alternative financing options with a thriving crowdfunding market. This is great news for investors as it is the perfect time to get started on investments in this segment. To begin with, you could check out the KredX platform to start investing and earning big! Happy investing!