Working Capital Explained and Why Is it Important

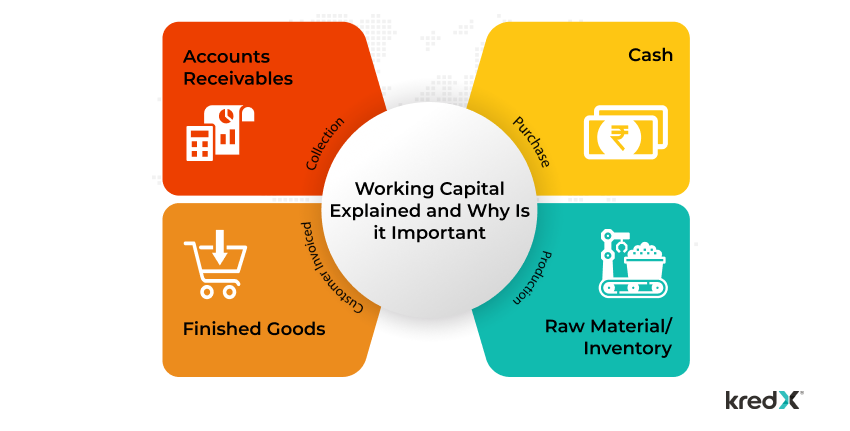

Working capital refers to the difference between a company’s current assets (such as cash, accounts receivable, and inventory) and its current liabilities (such as accounts payable, accrued expenses, and short-term debt). It represents the funds that a company has available for its day-to-day operations and is used to finance its short-term obligations.

In other words, working capital is the money a company uses to cover its short-term expenses and debts. It is a measure of a company’s liquidity and its ability to meet its financial obligations in the short term. Companies with strong working capital manage unexpected expenses better, while those with weak working capital may struggle to meet their obligations and may be at risk of financial distress.

Importance of Working Capital

Working capital is important because it represents a company’s ability to pay its bills and meet its short-term financial obligations. If a business does not have sufficient operating capital, it may struggle to pay suppliers, meet payroll obligations, or invest in growth opportunities. On the other hand, having too much working capital can indicate that a company is not investing in growth opportunities or managing its cash flow effectively.

Having a healthy level of working capital is particularly important for small businesses, which often have limited access to credit and may not have the resources to weather a cash flow crisis. By monitoring their working capital, businesses can ensure they have the funds necessary to operate and grow their operations over the long term.

Regenerate response

Let’s take the example of a small retail store that sells clothes. The store has the following assets and liabilities:

Current Assets

-

- Cash: $5,000

-

- Inventory: $10,000

-

- Accounts Receivable: $3,000

Current Liabilities

-

- Accounts Payable: $7,000

-

- Short-term loan: $3,000

To calculate the store’s working capital, we subtract its current liabilities from its current assets:

| Working Capital = | Current Assets – Current Liabilities |

| Working Capital = | ($5,000 + $10,000 + $3,000) – ($7,000 + $3,000) |

| Working Capital = | $18,000 – $10,000 |

| Working Capital = | $8,000 |

This means that the store has $8,000 of working capital available to cover its short-term expenses and obligations.

If the store were to have a negative working capital, it would mean that it does not have enough current assets to cover its current liabilities. This can indicate that the store may struggle to pay its bills and may need to take measures to increase its working capital, such as cutting costs or increasing sales.

Types of Working Capital

Gross Working Capital

This refers to the total current assets of a business, including cash, inventory, accounts receivable, and other assets that can be converted into cash within a year. Gross working capital is important because it represents the number of resources a company has available to fund its day-to-day operations and meet its short-term obligations.

Net Working Capital

This refers to the difference between a company’s current assets and its current liabilities and represents the amount of capital that a company has available to invest in growth opportunities or to pay off long-term debt. Net working capital is calculated by subtracting current liabilities from current assets. A positive net working capital indicates that a company has enough liquid resources to meet its short-term obligations.

Both types of working capital are important for a company to manage effectively, as having too much or too little working capital can impact a business’s ability to operate and grow. A company that has too much-working capital may be holding onto excess inventory or not investing in growth opportunities, while a company with too little working capital may struggle to meet its financial obligations and may be at risk of defaulting on loans or other debt.

Working Capital Financing

Working capital financing refers to the various ways in which businesses can obtain the necessary funds to finance their day-to-day operations and meet their short-term financial obligations. Here are some common types of working capital financing –

1. Bank Loans

One of the most common ways for businesses to obtain working capital financing is through bank loans. These loans can be secured or unsecured and may have a fixed or variable interest rate.

2. Lines of credit

Similar to bank loans, lines of credit provide businesses with a pre-approved amount of funds that they can draw upon as needed to cover short-term expenses.

3. Invoice Financing

Businesses can obtain working capital by selling their unpaid invoices to a third-party financing company at a discount. The financing company pays the business a percentage of the invoice amount upfront and then collects payment from the customer when the invoice is due.

4. Inventory Financing

Businesses that carry a large inventory may be able to obtain financing by using their inventory as collateral for a loan.

5. Trade Credit

This refers to the practice of businesses extending credit to each other, such as when a supplier allows a customer to pay for goods or services at a later date.

6. Crowdfunding

Some businesses may be able to obtain working capital financing through crowdfunding platforms, where they can pitch their business idea and raise funds from a large number of individual investors.

Conclusion

It’s important for businesses to carefully consider their options and choose the financing methods that best fit their needs and financial situation. It’s also important to manage working capital effectively to ensure that the funds obtained through financing are used wisely and help to improve the business’s financial health over the long term.