What Is Invoice Discounting And How Does It Work

All businesses inevitably face cash crunches from time to time that usually spells trouble. While larger businesses search and utilise all viable solutions to keep their businesses afloat, small businesses often don’t have many options to choose from. Such businesses need financing mechanisms that are more flexible and specifically cater to their cash flow needs. Invoice Discounting is an alternative financing solution for these businesses that provides working capital finance by utilising the value of their invoices.

Invoices As Pseudo Collateral:

Traditional Finance Options for businesses require collateral in the form of assets like property, machinery, etc. While availing invoice financing services like Invoice Discounting, there is a zero-collateral requirement as the benefit is transferred between the parties solely on the basis of invoices for already-delivered services/products.

Why Invoice Discounting?

Small businesses either provide services or products to big corporates. These small businesses thus form an integral part of Supply Chain for big corporates. Once the goods or services are supplied, these small businesses raise invoices to receive payment for their services and goods. These invoices are then sent for approval to the big corporates. Once approved and verified, the small business receives payment. This entire process can take anywhere between 30-120 days which means that businesses are devoid of their money for a long time, affecting their financial health.

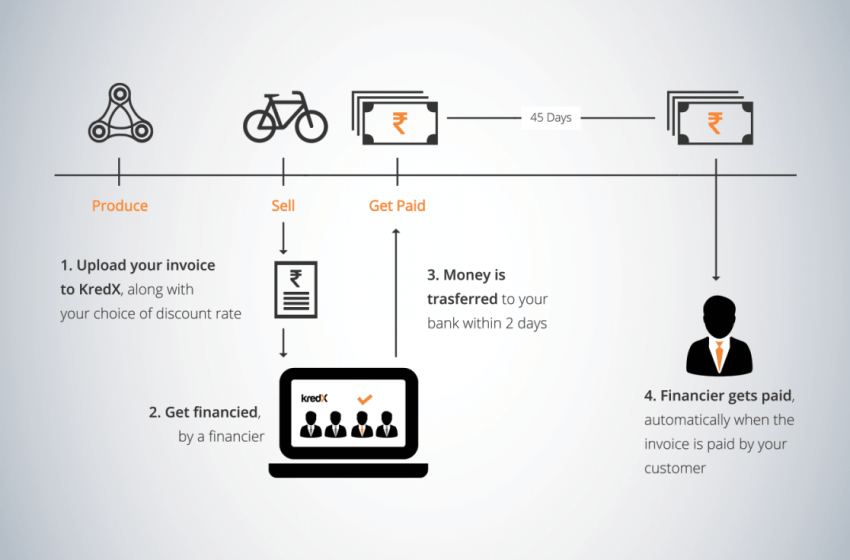

How Does Invoice Discounting Work?

- Small Business raises Invoices against the Big Corporate (Enterprise/Blue-chip Company) for the services provided/goods supplied.

- To avoid the delay, they can bring their invoices to Invoice Discounting companies such as KredX for confidential invoice discounting.

- In 1-2 days, these invoices are converted to cash and transferred to small businesses at a pre-set discounting rate and tenure (normally ranging from 30-120 days).

- Small Business completes multiple business cycles in this tenure and upon release of payment from corporate, repays the Invoice Discounting Service Provider.

Discounting invoices hence provides businesses funds upfront rather than waiting for 30-120 days. The completion of multiple business cycles further helps in improving cash flow and increasing revenue rather than limiting operations due to a lack of funds.