The Supply Chain Reaction On Business Growth

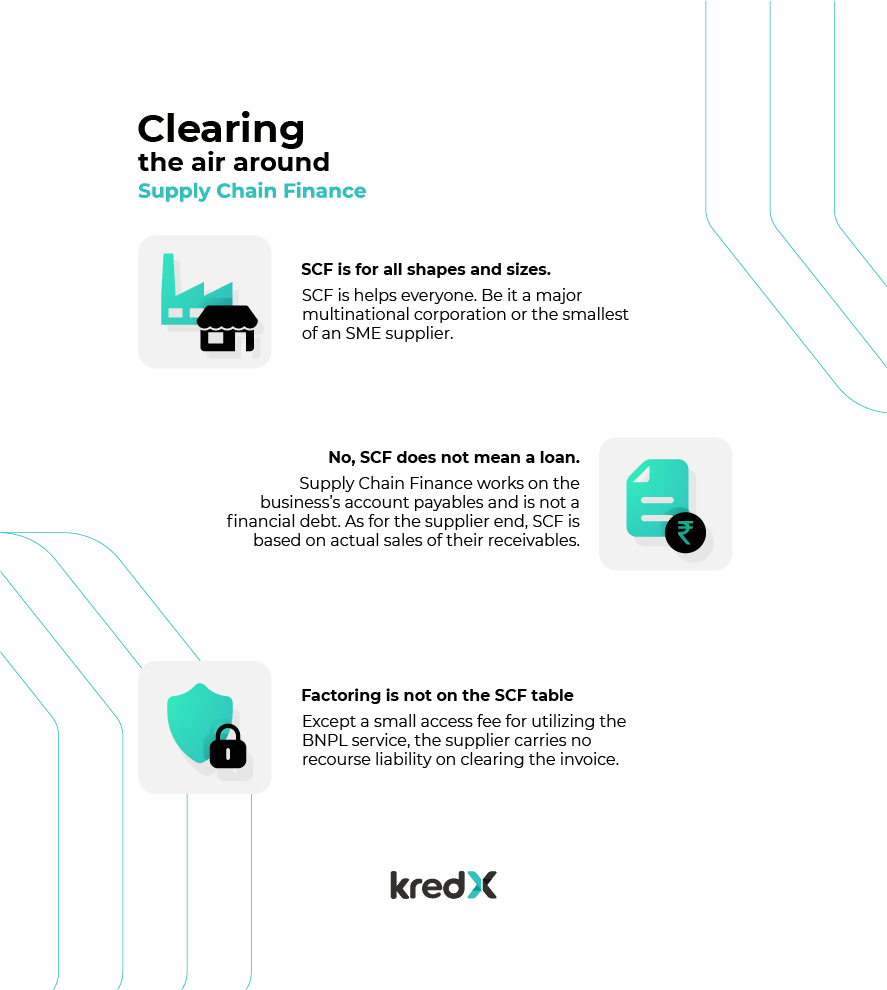

From obtaining materials from the warehouse to delivering them to the end consumer, a supply chain is a roadmap that defines every phase of any business operation. In simple terms, Supply Chain Finance revolves around optimising a supply chain network with the help of finance. The layered world of a supply chain that constitutes entities such as businesses, suppliers, vendors, retailers, and distributors carries multiple payment terms within. By bringing in technology that allows enterprises to extend their payment timelines and helping small-scale suppliers clear their dues sooner, Supply Chain Financing makes lives easier.

It’s All About The Working Capital

Supply Chain Finance helps optimise the companies’ and the suppliers’ working capital by stepping in wherever there is a gap to bridge, making it a win-win situation for everyone. Secondly, by using revolutionising technology, Supply Chain Finance further simplifies its application and paves the way for a higher yet rapid procurement.

By providing tech solutions like Invoice Discounting, enterprises get to use their payables and better manage cash flows. At the same time, the Buy Now Pay Later Solution helps suppliers and retailers access immediate financing under a flexible repayment window.

Understanding Supply Chain Finance

Once a supplier issues an invoice, it is sent over to the buyer for approval. When the company, or the buyer, approves it, Supply Chain Finance comes into play. It helps suppliers receive the payment immediately, on the basis of the approved invoice, while increasing the actual repayment window for the buyer.

Let us look at how KredX’s Buy Now Pay Later solution helps buyers enhance their credit limit while suppliers receive their payments well in time. Moreover, our BNPL solution can also be extended to the other end of the spectrum, where the Distributors and Dealers can make use of BNPL to clear their dues in time, extending their repayment window.

Supply Chain Finance Is The Future

Now that we witness that most businesses are going beyond borders, managing operations and maintaining supply, it brings significant opportunities for global supply chain management. With consumer buying patterns altering every minute, supply chain financing is becoming increasingly important with the passing day. The proper use of Supply Chain Finance tools can bring in a financial revolution that strengthens not just businesses but the entire supply chain, including small-scale vendors and even retailers. Are you ready to take part in this chain revolution with KredX?