Best Short-Term Investment Options Investors Should Consider

Time frames are of primary importance for any investment to meaningfully assist your financial goals. The growth you expect needs tangible monetary reinforcements at the right time. In this context, short term investments, with a duration of fewer than 5 years can be critical for your financial planning. Successful long term plans are often complemented by well-executed short term investments. These small packets of monetary success that you doggedly pursue can obviously have a big impact on your personal finances. These are the index points that make up the overall flavor of your profit accumulation. Let us take a look at some of the short term investments that can have a big impact.

What is Short Term Investment?

Short-term investments, also known as marketable securities or temporary investments, are financial instruments that typically have a maturity period of less than one year. These are designed to provide a safe harbor for cash while offering a higher yield than a regular savings account, without locking in money for a long period.

Best Short-Term Investment Options

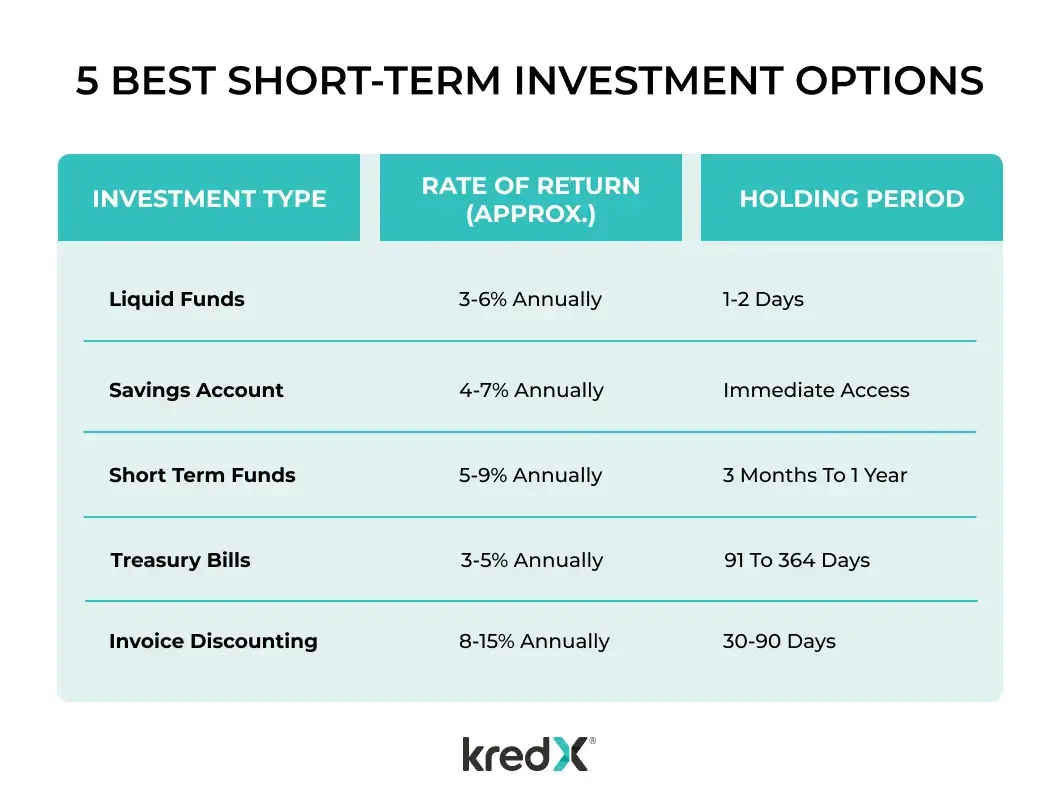

Here are the 5 best short-term investment options – 1. Liquid Funds

1. Liquid Funds

Liquid funds are low-risk investments that always manage to maintain their Net Asset Value (NAV). This makes liquid funds a relatively safe alternative in an increasingly risky investment space that sometimes seems dire. This is because liquid funds deal in short term securities offered by the government, this, in turn, makes the stability factor very high in this type of investment scheme. Although, contrary to its name, liquid funds are not as liquid as traditional bank deposits. The returns are modest but the biggest highlight is that these mutual funds are extremely tax efficient. The main of utilizing liquid funds should be to have access to short-term income solutions that are low return investments as much as they are low risk.

2. Savings Account

The point of having a savings account is to have access to liquid cash at all times. Banks offer different interest rates for the amount you have deposited which varies from 4 to 7 percent. Certain banks even offer free accident cover to new customers as they open a savings account. This is one of the most reliable ways to invest your funds in a safe manner.

3. Short Term Funds

Short term funds have a focus on investment protection with a really flexible tenure rate. They provide an investor with appreciable rates of interest. The point of interest as far as short term funds are concerned would be that the best duration for these would range in months. The applicability of short term funds will also have the added incentive of putting your investment under a very modest tax bracket.

4. Treasury Bills

RBI (Reserve Bank of India) institutes auctions for the purpose of selling treasury bills to the general public on a monthly basis. These are very low-risk investments as the bills themselves are supplied by the Central Government. Treasury bills are issued with a discount on actual value and after a maturity period which can range from 91 to 364 days, the actual value of the treasury bill is released in favor of the investor. The interest rate on these bills, however, is determined by market forces. Treasury bills are a huge part of the bill market in India that propagate lucrative trading practices.

5. Invoice Discounting

Invoice discounting practices have been transforming the way small-scale enterprises function for a long time now. This service helps assist the financial needs of these organisations without the use of interest or credit accumulation mechanisms that could potentially land their businesses at risk. What is often forgotten in this context, is the fact that invoice discounting is a spectacular investment opportunity that can lead to tangible gains for a prospecting investor. This is because the invoices which are raised against prominent blue-chip companies offer a very safe avenue for capital accumulation with minimal risks.

How Short Term Investments Work?

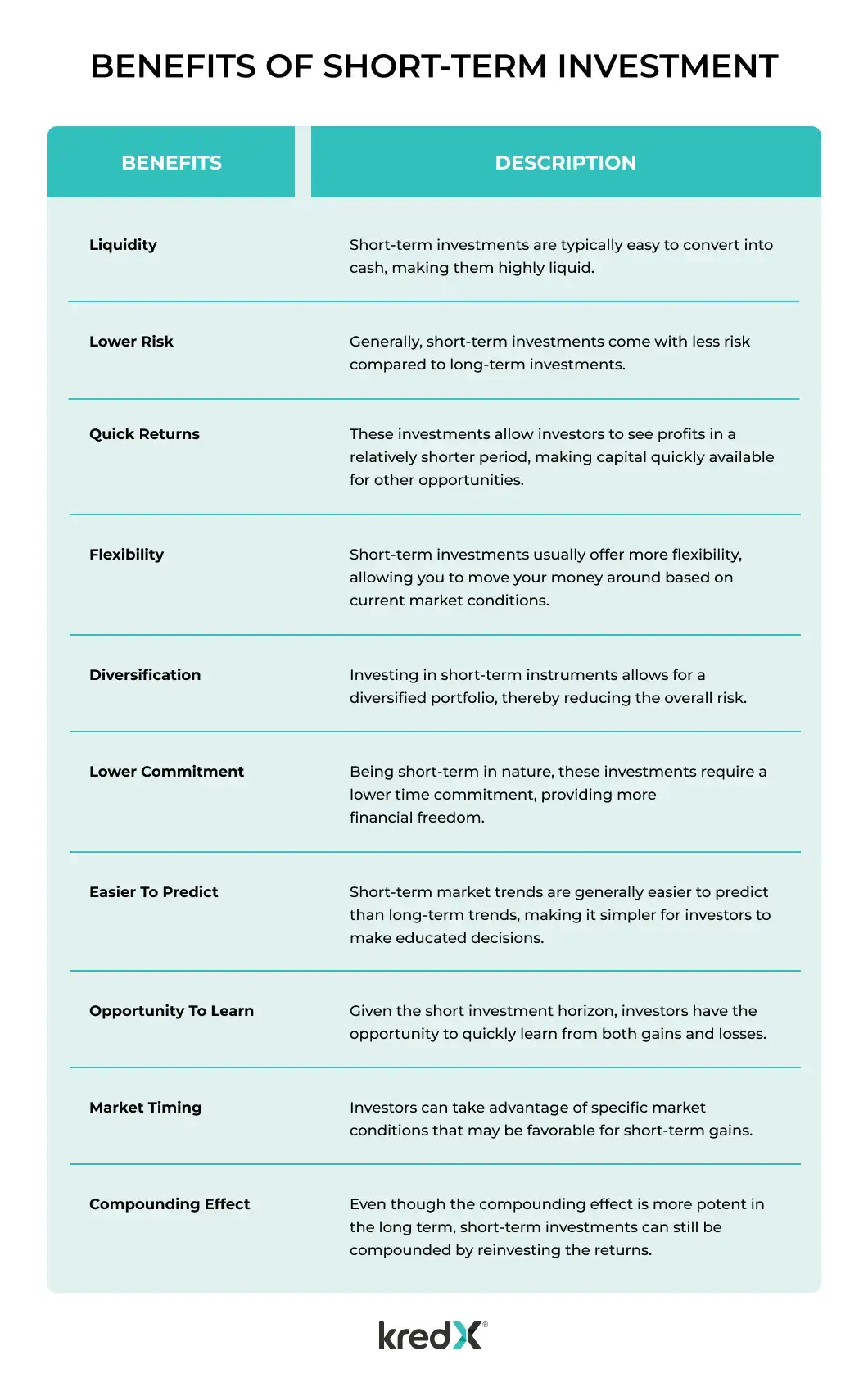

By setting clear financial objectives, whether for upcoming expenditures or optimizing surplus cash, they select suitable assets based on risk tolerance, liquidity needs, and expected returns. These assets, which range from savings accounts to money market funds or short-term bonds, accumulate returns via interest, dividends, or capital appreciation during their brief duration. Once the investment reaches its maturity or the investor’s goal is achieved, the funds can be liquidated or redirected into another short-term opportunity. It’s vital for investors to be conscious of the timelines associated with these investments, as some might have penalties for early withdrawals, and to account for potential tax implications on their earnings.

Features of Short term Investment

Here are the features of short-term investments

- Duration: Typically matures in one year or less.

- Liquidity: High; easily converted into cash.

- Safety: Prioritizes capital preservation.

- Return on Investment: Generally lower than long-term investments.

- Flexibility: Adaptable to changing market conditions or financial goals.

- Accessibility: Available to both individual and institutional investors.

- Tax Implications: Potential higher tax rates on earnings.

- Diverse Options: Includes savings accounts, treasury bills, and more.

- Minimal Entry Barriers: Low minimum deposit requirements.

- Predictability: Easier to forecast returns, especially with fixed rates.

Bottom Line

KredX offers a quite novel solution for the confused investor who is looking to maximize his profits while functioning under the lowest bracket of market risk. As a short term investment, Invoice Discounting is an important money mechanism that provides significant monetary appreciation in short time-frames.

FAQS

1. What qualifies as a short-term investment?

A short-term investment typically has a maturity period of less than one year. It is designed to provide quick returns and is generally considered to be lower in risk compared to long-term investments.

2. What types of financial instruments are considered short-term investments?

Liquid funds, savings accounts, short-term funds, treasury bills, and invoice discounting are common examples of short-term investments.

3. Why should investors consider short-term investments?

Short-term investments are suitable for goals that are immediate or near-term. They offer more liquidity and usually come with lower risk compared to long-term investments.

4. Are short-term investments safe?

While generally lower in risk compared to long-term investments, the safety of a short-term investment depends on various factors such as the creditworthiness of the issuer and current market conditions.