While there are many investment return comparison websites available on the internet, comparisons with the alternative investment asset class are hard to find. To help our patrons, we have made a comparison of the KredX returns with other top-performing asset classes.

Nearly a year back, the Indian economy was hit by the news of the downfall of Infrastructure Lease and Financing Services (IL&FS). This led to MSMEs facing a severe cash crunch. Investors who had invested in debt mutual funds incurred huge losses as the credit rating of the company crashed, resulting in a drop in NAV (Net Asset Value). In light of this entire fiasco, investors needed an option which was safer and simultaneously gave higher returns.

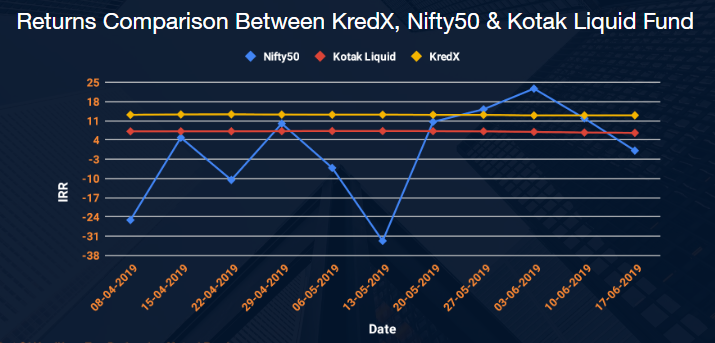

KredX is an online invoice discounting platform, which enables investors to invest in a unique short-term alternative investment option providing above-market returns. Presented below is the IRR comparison between KredX and the top-performing asset classes.

The above line graph shows a return comparison of KredX with Nifty50 and Kotak Liquid from 01 April 2019 to 17 June 2019.

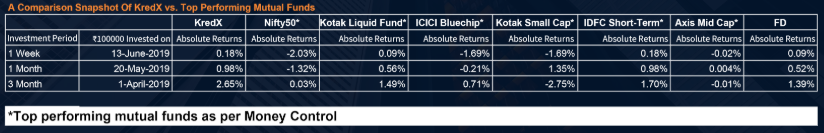

The table below shows the returns comparison of KredX with ICICI Bluechip, Kotal Small Cap, IDFC Short-Term, Axis Mid Cap, and FD. The amount invested for each of the assets class is Rs 1,00,000, and the absolute return rate is calculated for 1 week, 1 month, and 3 months. The table mentions absolute returns for each of the mentioned asset class correspondings to the investment period.

As always, in case of any queries regarding this process or any other, patrons can reach out to us at info@kredx.com.

Salarpuria Softzone, Ground floor, Wing 'A', Tower A, Dr Puneeth Rajkumar Rd, Bellandur, Bengaluru, Karnataka 560103

+1 212-602-9641

info@example.com