Key Highlights Of The 2024 Budget For Businesses

This year, Union Finance Minister Nirmala Sitharaman presented her 6th Budget, an Interim Budget, running up to the general elections scheduled to take place later this year. During her presentation of the 2024 Budget, the Finance Minister emphasized that the Government is working towards making India ‘Viksit Bharat’ by 2047 with the motto being “Sabka Sath, Sabka Vikas.”

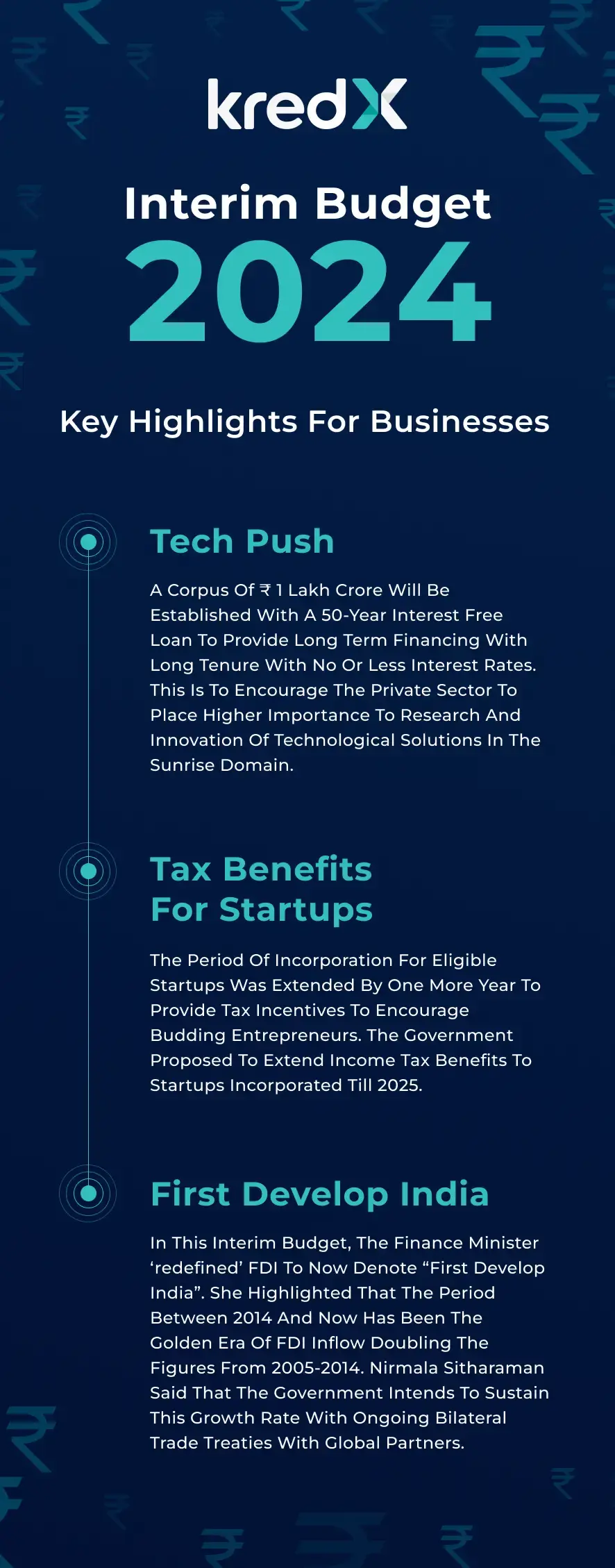

Although the Budget was primarily focused on the welfare of the poor, women, youth, and farmers, there were some proposals that were centered towards the upliftment of businesses. Let’s take a look at what this short-term financial plan as proposed by the Finance Minister Nirmala Sitaraman had in store for businesses –

Overall, the 2024 Interim Budget, despite not introducing any substantial changes to the existing policies concerning businesses, paints an optimistic picture of the Government’s intention to foster a growth ecosystem for businesses. This sentiment has resonated with business leaders like Manish Kumar, CEO and Founder of KredX, who had the following to say about the 2024 Interim Budget –

“As anticipated, this Interim Budget did not feature major announcements or changes; however, it instills confidence within the business community, signaling the government’s ongoing commitment to fostering a favorable environment for entrepreneurs, startups, and the MSME sectors.

The government’s dedicated focus on the Skill India Mission, geared towards creating an advanced nation, holds the potential to generate employment opportunities, drive technological advancements, foster entrepreneurship, and promote inclusive growth. The upskilling of youth and the establishment of new ITIs represent significant strides in the right direction, aligning seamlessly with our vision for innovation and global market leadership while simultaneously creating fresh employment prospects.

The allocation of a ₹1 lakh crore corpus, accompanied by a 50-year interest-free loan for research and innovation, emerges as a transformative catalyst for long-term financing, particularly propelling innovation within sunrise sectors, especially amid the post-“funding winter” phase. For fintechs particularly, this significant financial backing offers an opportunity to revolutionize financial services through advancements in blockchain, artificial intelligence, and data analytics, fostering efficiency and security. Moreover, the infusion of funds can drive the implementation of cutting-edge technologies like IoT and automation, optimizing processes and bolstering overall operational resilience.

Furthermore, the extension of tax benefits for startups until 2025, alongside the government’s ‘First Develop India’ focus on Foreign Direct Investment (FDI) policies, underscores the commitment to supporting and strengthening entrepreneurial efforts. This strategic move not only extends a favorable period of tax incentives for startups, promoting their sustained development but also aligns with India’s economic priorities by fostering an environment conducive to both domestic and international investment. These forward-looking policy measures not only stimulate innovation and job creation but also lay the foundation for enduring economic development, positioning India as an enticing destination for startup ventures and foreign capital alike.

However, the budget reveals a shortfall in capital expenditure, with a meager 11% increase that barely offsets inflation, prompting expectations for more strategic investments in the post-2024 elections full-fledged budget. Additionally, the industry had anticipated tax benefits, both personal and corporate, but no changes were announced, leaving room for hope and expectations for the future.”