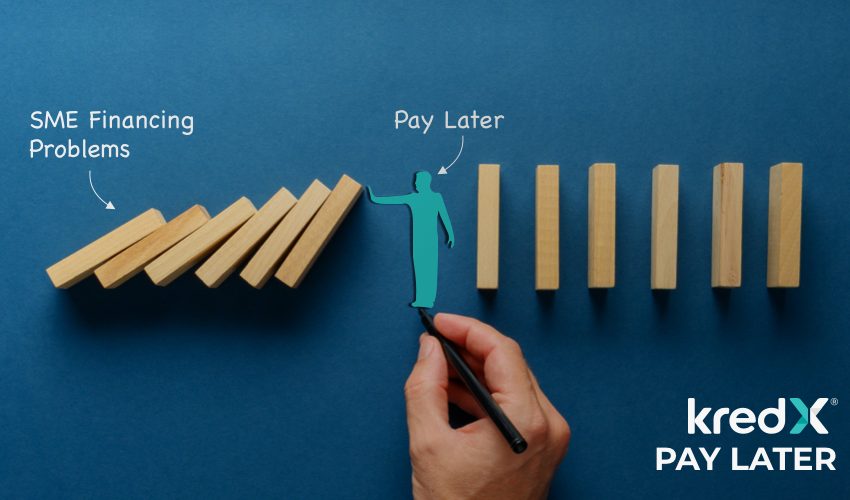

How Is Buy Now Pay Later Solving SME Financing Problems?

SME financing has always been challenging with the traditional banking system as most borrowers lacked the requisite collateral. The recent economic trend of Buy Now Pay Later (BNPL) has made financing easier for small and medium-sized enterprises.

The increasing growth of B2B commerce in India has led to the development of various innovative financing solutions. Companies such as KredX have made it easier for small businesses to solve their cash flow problems by offering a closed-loop channel financing solution, KredX Pay Later, that uses the latest technology to solve working capital needs.

How Does BNPL Work for Small Businesses?

Accessing formal credit has always been a problem for small and medium-sized businesses. People who aspired to create new ventures often had to back out because of the formalities associated with traditional credit facilities.

BNPL is a short-term lending facility that allows borrowers to purchase goods and services on credit and pay for them later. It allows business buyers to spread costs and delay B2B payments, while B2B merchants are fully paid up front.

BNPL is the perfect alternative option for SME financing. It takes the processes and agreements of formal credit and customises it as per the needs of e-commerce. When businesses are expected to make payments immediately, they might face cash flow problems.

Mentioned below is the process of how BNPL for B2B transactions works:

- First, the customer purchases a product or a service through a retailer or participating merchant.

- They have to choose BNPL at the payment gateway after checking and agreeing to the service provider’s terms and conditions.

- The buyers have to set a date on which they will pay the entire amount. It needs to be noted here that the merchant will receive the amount instantly.

- Another critical point is that customers can pay the amount with minimal interest.

Benefits of BNPL for Small Businesses

BNPL for B2B payments is ushering in massive transformations in the SME landscape of India. Discussed below are some of its key benefits:

-

Avoids Excess Dependency on Other Financial Products

With BNPL, businesses can purchase products or services without depending excessively on other financial products such as business credit cards. B2B customers can buy the products without worrying about using up all their available credit.

-

Provides an Easy and Seamless Buying Experience

BNPL is an SME financing option that is easily available online. SMEs and new ventures easily meet the eligibility parameters of fintech players like KredX. These companies provide a hassle-free documentation process that considerably improves the user experience.

-

Minimises Strain on Cash Flow

It provides small businesses with the freedom to control their money. For example, they can choose whether to pay the entire amount later or in instalments, so they receive greater autonomy over their finances.

-

Effectively Reduces Risk Factor

The BNPL option uses information related to open banking, credit and alternative data for evaluating the credit criteria. This not only reduces the overall risk factor but also leads to significant improvement in credit inclusivity for new ventures.

Bottom Line

SME financing has become easier with Buy Now Pay Later. It solves cash flow problems of small and medium enterprises. While buyers receive the products or services instantly, sellers benefit from increased revenue.