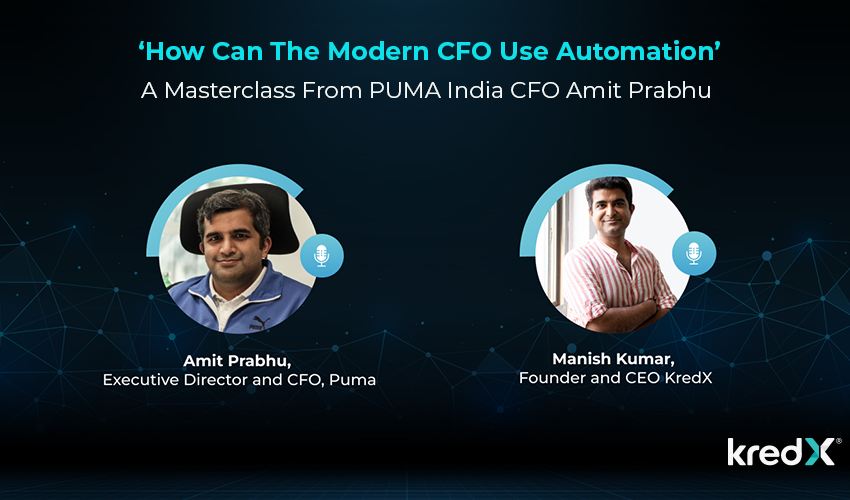

How Can The Modern CFO Use Automation: A Masterclass From PUMA India CFO Amit Prabhu

The first wave of automation in finance happened in the 90s, with the popularisation of enterprise resource planning systems or ERPs. The finance function has since evolved, with the COVID-19 global pandemic speeding up the transformation of this landscape. Some three decades later, automation is once again the buzzword in finance teams.

From processing payments to generating invoices and reconciling them with purchase orders and receipts, finance is a complex, time-consuming function which is the centre of all businesses, from mom-and-pop shops to multinationals. Automating finance functions can help companies to streamline their financial processes, reduce manual tasks, and help decision-makers take informed decisions based on data.

From reducing the risk of errors and improving collaboration to enabling data-driven decision-making and providing a clear and updated audit trail, automation has the power to transform the finance department of any business. So why is automation a necessity in today’s fast-paced business environment? We invited Amit Prabhu, PUMA India CFO and Executive Director, to delve into the topic in a conversation with KredX CEO Manish Kumar. Here are the highlights from the conversation:

Monthly Book Closure Vs Year-End Book Closure

Since the government has stringent rules wherein corporates must complete their book closing within strict timelines, and with the added stress from SEBI, professionals always feel the pressure. If we go back, the concept of periodic book closing has been alien for the last 25 years. But large corporates and multinationals had them and a system in place for a periodic closure. Generally, an annual closure is way simpler than a monthly/periodic closure because it revolves around the usual data consolidated at the end of the year, such as financial standpoint, incremental data, and legal and reporting compliances. In the case of monthly closure, this method takes place 12 times, and it cannot follow the age-old technique of human efforts going into it as it becomes a complicated process.

Brands deal with a limited set of Pan India distributors and never reach the end consumer. On the other hand, distribution or trading businesses often happen through a more physical distribution network, where a wholesaler is involved rather than a retailer. That has now changed when retail or e-commerce comes into the picture, bringing a sea of changes in how and who we sell. Such transformations have impacted the way transactions take place and the volumes of it. The transaction sizes have become more extensive, which ultimately makes a monthly closure activity much more complicated.

Simplifying The Reconciliation Process

While dealing with massive transaction volumes, especially in the retail space, cannot be done with human effort. Corporates need to have an automated system in place to record such high transaction volumes and bring out any outliers. The primary focus of businesses needs to be on regularly integrating such data into the ERP, which is a challenge given there’s a massive chunk of data to be integrated and reconciled in a single system at a transaction level. Therefore, different parts of the business end up using different functions; for instance, the collection process, taxation, revenue recognition at the end of each month etc., all use different solutions. So, different parts use different solutions, and it’s all about where the business wants to concentrate.

Impact Of Timely Bookkeeping On Business Finances

As previously mentioned, the transaction volume can be a significant challenge as businesses intend to capture every minute detail about the vendor. Technology plays a major role here by capturing the transaction into the accounting system, reconciling it in the GST system, and much more. Businesses that lack in doing that might face a potential revenue leakage because having such a transaction volume entered manually and keeping it compliant with regulations can elevate the chances of errors. Therefore, without an automated system, a business might be missing out on input credits and vital data.

According to a survey by the financial software company, 49% of accounting and finance professionals believe that automation can help reduce errors in financial statements, while 40% believe it can improve the accuracy of the closing process. Hence, in today’s fast-paced business world, companies must leverage automation to streamline their book closing process and stay ahead of the competition. Furthermore, with the introduction of banking, digitization changed the way businesses functioned. It became mandatory for them to work digitally, ultimately reducing the presence of physical transactions. Digital signatures replaced the inks, we could see scanned documents instead of piles of papers on the tables, and transactions happened via the bank’s digital platform. Today, we are all shifting into an online world where everything is paperless and error-free. And if this is automated into the operating system of a business, it becomes a much simpler process.

The Next Big Move

To ensure timely bookkeeping, businesses can work closely with different banks and explore peer-to-peer network connectivities with each of the banks for various transactions so that they can independently work on the reconciliation process. Furthermore, corporates can work with foreign banks to create joint solutions, which can help them provide better insights into large-volume transactions, especially on the e-commerce side. Platforms like KredX, India’s largest supply chain solution platform, provide end-to-end solutions for payables and receivables, along with consolidated reports.

The fintech space needs a big move that can smoothen how corporates interact with each other on the transactions front to avoid challenges such as pricing errors, missing out on small variances amidst large chunks of data, and building up other errors. There is a demand for a protocol that can help businesses which can help enterprises to transmit information and get feedback on a real-time basis rather than doing it once every three months.

To resolve multiple issues such as the movement of goods, zero inventory, and much more, KredX offers Cash Management Solutions, which talks about trade being a double hook product where the solution is connected to the business’s ERP. The multi-layered cash management system works with banks, customers, vendors, and suppliers, creating a single solution to show the business’s cash inflow and outflow. The solution has reduced the disputes to almost 30% and around 50% reduction in the TAT to do that.

Automation: A Value-Add To Your Book Closing Activity

In the present day, much time is spent gathering the number, which must be resolved first. Most enterprises had an ERP implementation in the late 90s and early 2000s, but the world has changed quite a bit in these 20 years. Many enterprises today have moved or upgraded their ERP to the next level with various features like business reporting, tools, tableau, and other visualisation tools that help them. But from a reporting point of view, there needs to be more consolidation across entities and gathering information directly from the ERP. For a month’s closure, businesses cannot have humans working day in and out and spending hours doing such repetitive activities. Analysing the data, fixing it, and carrying out a smooth book closing on time with the help of automation seems more meaningful.