Mastering the Working Capital Cycle: The Key to Business Success

Working capital cycle, also known as the cash conversion cycle, refers to the amount of time it takes for a company to convert its current assets into cash and then use that cash to pay off its current liabilities. It measures a company’s ability to efficiently manage its cash flows.

The working capital cycle is important because it helps businesses maintain their operations and meet their financial obligations in the short term. A negative working capital cycle means that a company can use its current assets to pay off its current liabilities quickly, which can be beneficial in managing cash flow. However, a positive working capital cycle can indicate that a company is not managing its cash flow efficiently and may be experiencing financial difficulties.

The Steps Involved In the Working Capital Cycle

The working capital cycle (WCC) refers to the period it takes for a company to convert its net current assets and current liabilities into cash. It’s crucial to understand how efficiently a company manages its operational liquidity. Here are the key steps involved in the working capital cycle –

Purchasing Inventory

The cycle begins when a business uses its cash to purchase raw materials or inventory. This is the initial investment before any revenue is generated.

Production or Storage

Once the inventory is purchased, it is either used in production or stored. During this time, the company has cash tied up in its inventory.

Sales

The inventory is then sold, either on credit or for cash. Sales on credit convert the inventory into accounts receivable, while cash sales directly inject cash back into the business.

Accounts Receivable Collection

If sales are made on credit, the company needs to collect the receivables. The time it takes to collect these payments is critical in the working capital cycle. Faster collection improves the cycle.

Paying Off Liabilities

Throughout this cycle, the business will have current liabilities such as accounts payable (money owed to suppliers), short-term loans, etc. Paying off these liabilities efficiently is crucial to keep the cycle moving smoothly.

Cycle Repeats

The cycle repeats itself once the collected cash is used again to purchase more inventory or pay for other operational costs, thus continuing the flow of working capital.

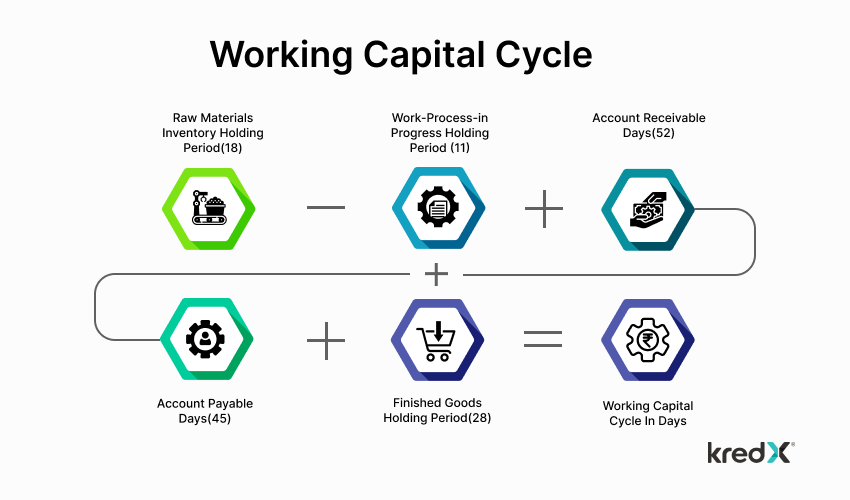

The length of the working capital cycle is calculated as Inventory Days + Accounts Receivable Days – Accounts Payable Days. A shorter working capital cycle is generally preferable as it indicates that the company is able to quickly convert its assets into cash, thereby improving liquidity and potentially reducing the need for external financing.

Working Capital Cycle Formula

Working Capital Cycle Formula is a pivotal financial metric that businesses use to gauge the efficiency of their cash flow management. By calculating the time taken to convert net current assets and liabilities into cash, this formula offers invaluable insights into a company’s operational liquidity.

Working Capital Cycle = Inventory Days + Accounts Receivable Days – Accounts Payable Days

What Are the Positives And Negatives of Working Capital Cycle?

A positive working capital cycle means that a company takes longer to convert its current assets into cash and use it to pay off its current liabilities. A negative working capital cycle means a company can pay off its current liabilities quickly using its current assets.

The Benefits of a Shorter Working Capital Cycle For Your Business

Shortening the working capital cycle helps businesses to manage their cash flow and reduce their reliance on external financing. This can be achieved by improving inventory management, collecting payments from customers more quickly, and negotiating better payment terms with suppliers.

Several factors can affect the working capital cycle, including economic conditions, industry trends, and the financial health of the company.

How to Reduce Working Capital Cycle?

To reduce the working capital cycle, businesses can consider implementing the following strategies:

- Reducing inventory levels by implementing just-in-time inventory management.

- Offering incentives for customers to pay their bills early.

- Negotiating longer payment terms with suppliers.

How To Calculate Working Your Capital Cycle?

To calculate your working capital cycle, you need to determine the number of days it takes for your business to convert its current assets into cash and then use that cash to pay off its current liabilities. Here are the steps involved in calculating the working capital cycle:

1. Determine the average number of days it takes for your business to sell its inventory. This is known as the inventory turnover period or inventory days.

Inventory Days = (Average Inventory / Cost Of Goods Sold) x 365

2. Determine the average number of days it takes for your business to collect payments from customers. This is known as the accounts receivable turnover period or accounts receivable days.

Accounts Receivable Days = (Average Accounts Receivable / Annual Credit Sales) x 365

3. Determine the average number of days it takes for your business to pay its bills to suppliers. This is known as the accounts payable turnover period or accounts payable days.

Accounts payable days = (Average accounts payable / Cost of goods sold) x 365

4. Subtract the accounts payable days from the sum of the inventory days and accounts receivable days to get the working capital cycle.

Working capital cycle = Inventory days + Accounts receivable days – Accounts payable days

An Example of How To Calculate the Working Capital Cycle:

Let’s say a company has an average inventory of ₹50,000, a cost of goods sold of ₹100,000, average accounts receivable of ₹25,000, annual credit sales of ₹200,000, and average accounts payable of ₹20,000.

Inventory days = (₹50,000 / ₹100,000) x 365 = 182.5 days

Accounts receivable days = (₹25,000 / ₹200,000) x 365 = 45.63 days

Accounts payable days = (₹20,000 / ₹100,000) x 365 = 73 days

Working capital cycle = 182.5 + 45.63 – 73 = 155.13 days

This means it takes the company an average of 155.13 days to convert its current assets into cash and pay off its current liabilities.

Examples Of Industries With Different Working Capital Cycles

1. Retail

Retail businesses often have short working capital cycles, largely due to their ability to quickly convert inventory into sales and then collect payments from customers. This rapid turnover is sometimes further enhanced by using tools like invoice discounting, which allows businesses to receive immediate cash based on their accounts receivables. For example, a clothing store might have a working capital cycle of 30-60 days, but with invoice discounting, it can access the funds from sales almost immediately, further shortening the cycle and improving cash flow.

2. Manufacturing

Manufacturing businesses typically have longer working capital cycles because they need to maintain inventory levels and often offer longer payment terms to customers. For example, a car manufacturer might have a working capital cycle of 90-120 days.

3. Service

Consulting services generally have shorter working capital cycles because they do not hold inventory and typically collect payments from customers quickly. For example, a consulting firm might have a working capital cycle of 30-45 days.

Conclusion

Working capital cycle, crucial for financial health, involves efficiently managing inventory, accounts receivable, and accounts payable. This cycle determines how quickly a company can turn its assets into cash to meet liabilities. Efficient management leads to a shorter cycle, improving liquidity and reducing the need for external financing. Businesses can optimize this cycle by streamlining inventory processes, accelerating receivable collections, and negotiating better payment terms with suppliers, ultimately enhancing their operational efficiency and financial stability.